A TAX AGAINST DWELLINGS, LAND AND SLAVES

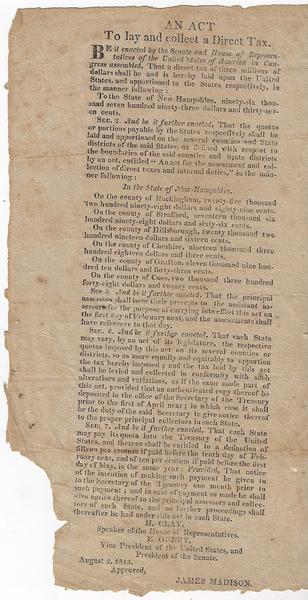

(New Hampshire) Madison, James. AN ACT TO LAY AND COLLECT A DIRECT TAX. (Caption Tutle). Washington, D.C. 1813. Federal broadside issued for the State of New Hampshire declaring a direct tax on Rockingham, Strafford, Hillsborough, Cheshire, Grafton, and Coos Counties in the amount of $ 96,917.46 to be divided proportionally by each county. This tax was assessed for all fifteen states in the Union and the broadside outline the timetable for payment and the percentage of discount for early payment. It is signed by Henry Clay, Speaker of the House, Vice President E. Gerry, and James Madison and dated August 2, 1813.

In 1813 a direct tax was made up property, income and poll taxes. The first to be direct to be levied in U. S. History was in 1798 and was assessed against dwellings, land, and slaves. The tax of 1813, is the second time in U. S. history that a direct tax was assessed, and its purpose was to raise revenue to pay for the war with Britain.

Source: Dictionary of American History, V, p. 230. (653)

Broadside, narrow 4to. 10 ½ x 5 ¾ inches. Paper brown with age, small piece missing from lower left corner with no loss of text; paper brown with age.